- The Green Executive Briefing

- Posts

- Carbon Markets: What Matters Now (and What to Do About It)

Carbon Markets: What Matters Now (and What to Do About It)

➡️The Growing Importance of Carbon Markets in Our Net-Zero Future

This week’s reading time: 5 minutes

Welcome to another edition of The Green Executive Briefing. In under 10 minutes, you’ll be fully updated on the latest happenings in Sustainability and ESG every Tuesday at 8am EST. 🌎

We sift through a vast array of articles and data from trusted sources, distill the information, and present it to you in simple, bite-sized pieces every week. 🌍

Subscribe Today 🌍

Compliance Carbon Markets:

36+ emissions trading schemes operate globally, covering ~18% of global greenhouse gas emissions

EU ETS leads by market value, while China operates the largest system by emissions coverage

Prices vary significantly across jurisdictions due to different supply and demand dynamics

More Readings

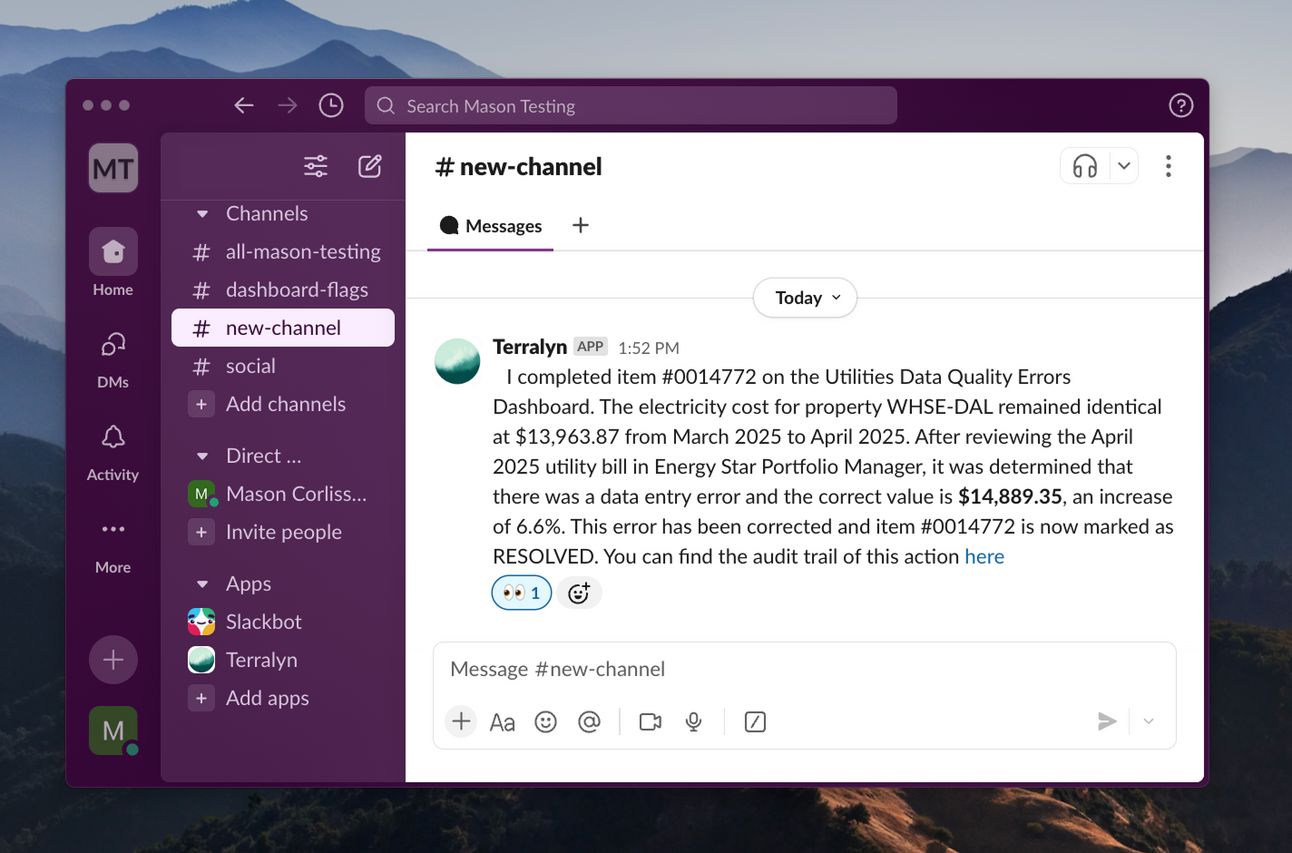

🌟 Spotlight: Terralyn.ai, Sustainability Pros Create Impact, Not Reports

Sustainability professionals create impact, not reports.

If this is the case, then why are teams spending >50% of their time handling data and reporting demands to comply with every XYZ acronym framework?

Sustainability platforms can help streamline 80% of the work, but the 20% gap is widening.

Your day is probably shuffling between systems: Email ↔️ Data warehouses ↔️ Carbon accounting platform ↔️ Excel ↔️ Reporting platform

Excel… so much work to be done in Excel

This is where we come in: Terralyn is building the first AI sustainability analyst for corporate sustainability teams, automating end-to-end workflows for data collection, data quality, analytics, and reporting—completing tasks, like a teammate, in the background 24/7.

If you can write a workflow as a list of steps, Terralyn can automate it

Terralyn is opening a private beta program for sustainability professionals where our team of experts will integrate Terralyn’s agentic capabilities into your daily workflows. If you are interested in participating, we would love to hear from you!

Feel free to find some time on my calendar link: https://calendly.com/terralyn/meeting-with-mason-at-terralyn

Mason Corliss

Founder, Terralyn

Want to get featured in the spotlight? Reply to this email: [email protected]

Small Budget, Big Impact: Outsmart Your Larger Competitors

Being outspent doesn't mean being outmarketed. Our latest resource showcases 15 small businesses that leveraged creativity instead of cash to achieve remarkable marketing wins against much larger competitors.

Proven techniques for standing out in crowded markets without massive budgets

Tactical approaches that turn resource constraints into competitive advantages

Real-world examples of small teams creating outsized market impact

Ready to level the playing field? Download now to discover the exact frameworks these brands used to compete and win.

🌟 Spotlight: The Sustainable Storytelling Sprint by Solarpunk Studio

Your sustainability work deserves so much more than a checkbox—it deserves a narrative that builds trust, secures buy-in, and sparks real momentum.

The Sustainable Storytelling Sprint™ from Solarpunk Studio is a two-day immersive workshop and content creation experience designed for sustainability, ESG, and communications teams. Solarpunk Studio helps mid-sized to enterprise-level organizations translate their internal initiatives into audience-ready narratives—aligned with ESG frameworks and stakeholder priorities.

✔️Align your messaging with carbon, waste, and equity goals

✔️Train your team in visual and strategic storytelling

✔️Walk away with six months of premium, ready-to-use video and content assets

Whether you’re preparing for a report, campaign, or executive briefing, we’ll help you showcase progress with clarity and credibility.

Book a discovery call and mention the special discount for Green Executive Briefing subscribers: https://app.hellobonsai.com/s/solarpunk-studio/discovery

Want to get featured in the spotlight? Reply to this email: [email protected]

Intro

As we face the mounting urgency of climate change, carbon markets have emerged as a critical tool for accelerating global decarbonization. MSCI's latest comprehensive guide reveals how these markets are evolving from niche mechanisms to essential infrastructure for achieving net-zero goals.

Main

Compliance Carbon Markets

Government-mandated systems like the EU Emissions Trading System (ETS) set hard caps on emissions, requiring companies to hold allowances for each tonne of CO₂ they emit. Key highlights:

36+ emissions trading schemes operate globally, covering ~18% of global greenhouse gas emissions

EU ETS leads by market value, while China operates the largest system by emissions coverage

Prices vary significantly across jurisdictions due to different supply and demand dynamics

Voluntary Carbon Markets

Corporate-driven initiatives where companies voluntarily purchase carbon credits to meet climate commitments:

336 million tonnes of carbon credits were issued in 2023

180 million tonnes were retired (used) by companies

Supply currently exceeds demand, creating a surplus of over 1 gigatonne

What Makes a High-Quality Carbon Credit?

The market is undergoing a fundamental shift toward integrity, with new standards emerging:

Essential Criteria:

Additionality: Would the emission reductions have happened without carbon credit financing?

Permanence: Will the reductions remain permanent over time?

Quantification: Are the emission reductions accurately measured?

Verification: Has the project been independently validated?

The Integrity Challenge

Current market analysis reveals concerning quality gaps:

Only 7% of projects receive the highest integrity ratings (A-AAA)

47% of projects fall into the lowest quality categories

Higher-integrity projects command premium prices, with a one-point improvement in integrity score associated with an 8% price increase

Main

Surprising Findings on Carbon Credit Users

Research reveals that companies actively using carbon credits are often climate leaders, not laggards:

Material carbon credit users outperform non-users:

Reduce absolute emissions 2x faster (3.6% vs 1.5% annually)

92% have set climate targets vs 52% of non-users

More likely to have externally validated targets

Industry Leaders

Top sectors by credit retirement (2021-2023):

Fossil fuels: 31%

Transportation: 18%

Services: 15%

Manufacturing: 13%

Main

Market Growth Projections

The voluntary carbon market could expand dramatically:

Current market value: ~$1.1 billion (2023)

Projected growth: $10-40 billion by 2030

Driver: 3,600+ listed companies have pledged net-zero commitments

For Investors

Carbon markets offer multiple engagement opportunities:

Direct investment in carbon credit projects

Portfolio assessment of companies' carbon strategies

Risk management through exposure to carbon pricing

Impact investing in natural capital and climate solutions

Increasing Disclosure Requirements

New regulations worldwide are mandating carbon credit transparency:

Key Jurisdictions Implementing Disclosure Rules:

EU: Corporate Sustainability Reporting Directive (2024)

US: SEC climate disclosure rules (2026)

California: Enhanced disclosure requirements (2025)

Multiple Asian markets: Various timelines through 2025

Claims and Communications

The era of simple "carbon neutral" claims is ending:

EU bans carbon neutrality claims based on offsets (2026)

New claim frameworks emerging (VCMI tiers, contribution claims)

Focus shifting from offsetting to "beyond value chain mitigation"

Key Trends to Watch

Technology Evolution:

Growing focus on engineered carbon removal (direct air capture, biochar)

Satellite monitoring improving verification capabilities

Blockchain platforms enhancing transparency

Market Infrastructure:

Standardized contracts reducing transaction complexity

Insurance products protecting against quality risks

Exchange trading increasing liquidity

Policy Development:

Article 6 implementation under the Paris Agreement

CORSIA requirements for aviation industry (2027)

National carbon pricing expansion globally

WRAPPING UP

🔮 CLOSING THOUGHT: The Bottom Line

Carbon markets are at a critical inflection point. While challenges around quality and claims persist, the convergence of increasing climate ambition, improving standards, and growing corporate leadership is creating unprecedented opportunities for credible climate action.

For companies and investors, the key is understanding that carbon markets are not just about compliance or offsetting—they're about accelerating the global transition to a low-carbon economy while supporting sustainable development worldwide.

The organizations that master carbon market navigation today will be best positioned to thrive in tomorrow's carbon-constrained world.

P.S. When you’re ready, here’s how I can help you:

Download our Dashboard GHG Accounting Scope 1, 2 & 3. Customize it with your organization's numbers to build a compelling business case.

Refer 2 other sustainability leader (see “Click to Share” button below)

Book a Consultation: Click HERE

GHG Accounting Strategies (Scope 1, 2 & 3)

ISO 14001 Compliance (Environmental Management)

Did you like today's email?Let me know what you thought so I can make the next email even better. |

CREDITS