- The Green Executive Briefing

- Posts

- From Background Noise to Business Crisis: The 5-Stage Journey Every ESG Issue Takes

From Background Noise to Business Crisis: The 5-Stage Journey Every ESG Issue Takes

➡️Understanding the pathway from social concern to boardroom priority

This week’s reading time: 7 minutes

Welcome to another edition of The Green Executive Briefing. In under 10 minutes, you’ll be fully updated on the latest happenings in Sustainability and ESG every Tuesday at 8am EST. 🌎

We sift through a vast array of articles and data from trusted sources, distill the information, and present it to you in simple, bite-sized pieces every week. 🌍

Subscribe Today 🌍

Topics For Today:

The Five-Stage Materiality Pipeline: How ESG issues evolve from background concerns to business-critical factors through a predictable pathway—from initial misalignment and catalyst events to stakeholder pressure, corporate response, and regulatory resolution

Real-World Case Studies: Examining how pharmaceutical pricing scandals, climate change concerns, and Tesla's electric vehicle disruption demonstrate different pathways to financial materiality across industries

Strategic Frameworks for Leaders: Actionable approaches for impact-first organizations to accelerate positive change and for profit-driven companies to identify emerging risks and opportunities before they become widely recognized

More Readings

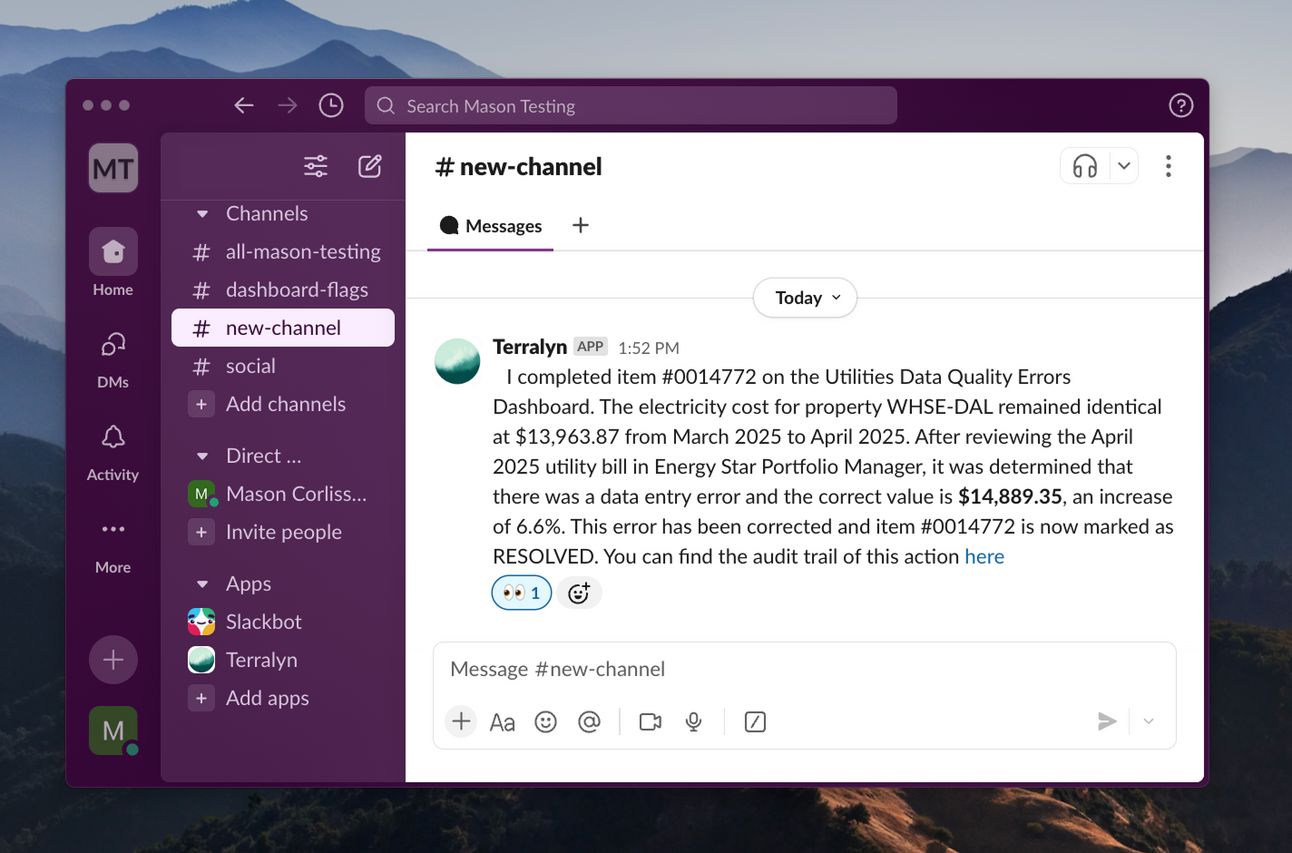

🌟 Spotlight: Terralyn.ai, Sustainability Pros Create Impact, Not Reports

Sustainability professionals create impact, not reports.

If this is the case, then why are teams spending >50% of their time handling data and reporting demands to comply with every XYZ acronym framework?

Sustainability platforms can help streamline 80% of the work, but the 20% gap is widening.

Your day is probably shuffling between systems: Email ↔️ Data warehouses ↔️ Carbon accounting platform ↔️ Excel ↔️ Reporting platform

Excel… so much work to be done in Excel

This is where we come in: Terralyn is building the first AI sustainability analyst for corporate sustainability teams, automating end-to-end workflows for data collection, data quality, analytics, and reporting—completing tasks, like a teammate, in the background 24/7.

If you can write a workflow as a list of steps, Terralyn can automate it

Terralyn is opening a private beta program for sustainability professionals where our team of experts will integrate Terralyn’s agentic capabilities into your daily workflows. If you are interested in participating, we would love to hear from you!

Feel free to find some time on my calendar link: https://calendly.com/terralyn/meeting-with-mason-at-terralyn

Mason Corliss

Founder, Terralyn

Want to get featured in the spotlight? Reply to this email: [email protected]

🌟 Spotlight: The Sustainable Storytelling Sprint by Solarpunk Studio

Your sustainability work deserves so much more than a checkbox—it deserves a narrative that builds trust, secures buy-in, and sparks real momentum.

The Sustainable Storytelling Sprint™ from Solarpunk Studio is a two-day immersive workshop and content creation experience designed for sustainability, ESG, and communications teams. Solarpunk Studio helps mid-sized to enterprise-level organizations translate their internal initiatives into audience-ready narratives—aligned with ESG frameworks and stakeholder priorities.

✔️Align your messaging with carbon, waste, and equity goals

✔️Train your team in visual and strategic storytelling

✔️Walk away with six months of premium, ready-to-use video and content assets

Whether you’re preparing for a report, campaign, or executive briefing, we’ll help you showcase progress with clarity and credibility.

Book a discovery call and mention the special discount for Green Executive Briefing subscribers: https://app.hellobonsai.com/s/solarpunk-studio/discovery

Want to get featured in the spotlight? Reply to this email: [email protected]

Intro

🌍 The $80 Billion Wake-Up Call

When Purdue Pharma filed for bankruptcy in September 2019, it wasn't due to a failed product launch or market downturn. The opioid manufacturer collapsed under the weight of thousands of lawsuits related to aggressive marketing practices that fueled America's addiction crisis—claiming over 400,000 lives since 1996. What was once considered an "ethical marketing" issue, traditionally deemed financially immaterial, had become a company-killing liability.

This dramatic transformation illustrates a critical reality facing today's business leaders: ESG issues don't remain static—they evolve from background concerns to material financial factors that can make or break companies.

Main

📌The Dynamic Nature of Financial Materiality

Beyond the Binary: Material vs. Immaterial

Most executives still think of ESG issues in binary terms—either material or immaterial. But groundbreaking research from Harvard Business School reveals that materiality is actually a dynamic process, not a fixed state. The crucial question isn't just whether an issue is material today, but how and when it might become material tomorrow.

This research, analyzing over 2,000 industry-ESG issue pairs across 77 industries, has identified predictable patterns in how environmental and social concerns transform into financial imperatives. Understanding these patterns provides unprecedented strategic advantages for organizations across the spectrum.

The Strategic Opportunity

This shift in perspective opens up powerful opportunities for forward-thinking leaders:

For impact-focused organizations: Understanding materiality pathways provides a roadmap for creating market-based incentives that align business behavior with social outcomes

For profit-driven companies: Monitoring emerging material issues enables proactive risk management and competitive advantage through early action

For investors: Anticipating materiality evolution creates opportunities to identify undervalued assets and avoid future stranded investments.

Main

📌The Five-Stage Materiality Framework

Research has identified a predictable five-stage pathway that ESG issues follow as they evolve toward financial materiality. Each stage presents distinct characteristics, risks, and opportunities for different stakeholders.

Stage 1: The Status Quo - When Misalignment Hides in Plain Sight

Every material issue begins with a period of apparent equilibrium where business practices and societal expectations seem aligned, even when significant misalignment exists beneath the surface. This deceptive stability persists due to several key factors:

Information Asymmetries: Society lacks complete information about the true extent of negative impacts. The tobacco industry operated for decades before the full health implications became widely understood. Similarly, for decades, the public recognized that fossil fuels caused some environmental damage, but the comprehensive scope and urgency of climate change remained unclear to most stakeholders.

Accepted Trade-offs: Society tolerates certain negative impacts as necessary costs of economic activity. High pharmaceutical prices were historically accepted as legitimate compensation for innovation risks and the high failure rates in drug development—until price increases became so extreme they could no longer be justified by R&D costs alone.

Regulatory Gaps: Existing regulatory frameworks may not adequately address emerging issues, creating space for potentially harmful practices to continue unchecked.

Main

📌Current Example: Pharmaceutical Environmental Contamination

A prime example of an issue currently in Stage 1 is pharmaceutical pollution. Right now, widespread pharmaceutical contamination from human metabolites and improperly disposed medications is affecting ecosystems, drinking water supplies, and human health worldwide. Despite growing environmental data indicating serious ecological impacts, pharmaceutical companies haven't been held financially responsible because society hasn't fully internalized the magnitude of this issue.

Several factors make this issue ripe for evolution:

Increasing potency of modern drugs amplifies environmental impact

Dramatic growth in daily prescription medication usage

Inadequate wastewater treatment systems in most urban areas globally

Growing investor awareness, with firms like Nordea Asset Management beginning to engage pharmaceutical companies on this topic

Main

📌 Stage 2: The Catalyst - When Equilibrium Breaks

Materiality journeys accelerate through catalyst events that disrupt the existing equilibrium. These catalysts fall into two primary categories:

Corporate Behavior Shift

Some companies deviate from industry norms, pursuing aggressive strategies that widen the gap between business practices and social expectations. The pharmaceutical pricing scandals of the 2010s provide clear examples:

Mylan's EpiPen Strategy: Despite the core drug (epinephrine) costing less than $1 per dose, Mylan leveraged its patent protection to increase EpiPen prices from $103.50 to $608.61 between 2009 and 2016—a nearly 500% increase for a life-saving medication.

Valeant's Acquisition Model: The company grew by acquiring pharmaceutical companies with debt financing, then aggressively increasing drug prices by over 500% in some cases, making previously affordable treatments inaccessible to many patients.

Turing Pharma's Extreme Pricing: The company purchased rights to Daraprim, a treatment for a relatively uncommon but serious illness, and increased the price per pill from $13.50 to $750—a 5,000% increase overnight.

These extreme deviations from accepted industry practices created public outrage and political attention that extended beyond the individual companies to scrutinize industry-wide pricing practices.

Societal Expectation Evolution

Alternatively, catalysts can emerge when new information or cultural shifts change what society considers acceptable corporate behavior. This evolution often occurs gradually, then accelerates rapidly once a tipping point is reached.

Climate Change Awareness: While the link between fossil fuels and climate change has been scientifically established for decades, the 2015 Paris Agreement marked a turning point in global consciousness. The agreement, combined with increasingly stark research about potential catastrophic consequences, fundamentally shifted societal expectations about corporate environmental responsibility.

Information Transparency: The introduction of "sunshine laws" in the pharmaceutical industry, requiring disclosure of payments to healthcare providers, suddenly made visible previously hidden relationships between drug companies and prescribing physicians. This transparency enabled investigative journalism and public scrutiny that wouldn't have been possible without access to this data.

Main

💡 Stage 3: Stakeholder Reaction - When Pressure Builds

NGOs, media, investors, and other stakeholders respond to growing misalignment through increasingly sophisticated and targeted campaigns. This stage is critical because it often determines whether an issue becomes material for individual companies or spreads to affect entire industries.

The Targeting Strategy: Isolation vs. Industry-Wide Pressure

Company-Specific Targeting: Stakeholders typically focus initial efforts on companies that deviate most significantly from industry norms. This strategy is more likely to succeed because:

The company's behavior can be clearly differentiated from peers

Industry associations may distance themselves from extreme actors

Regulatory attention focuses on outliers rather than systemic issues

The Marathon Pharmaceuticals case illustrates this dynamic perfectly. When the company priced its muscular dystrophy drug at $89,000 annually (compared to $1,200 for imports), the Pharmaceutical Research and Manufacturers Association (PhRMA) actively distanced itself from Marathon, despite the CEO being a board member. PhRMA threatened expulsion, forcing Marathon to quickly sell the drug and ultimately exit the industry entirely.

Industry-Wide Campaigns: When stakeholder pressure successfully targets entire industries, it can drive widespread convergence toward new standards. The movement against single-use plastic straws exemplifies this approach:

Environmental groups highlighted the estimated 500 million straws used daily in the US

Viral content (including videos of wildlife affected by plastic pollution) created emotional engagement

Cities like Seattle implemented bans, creating regulatory momentum

Companies like Starbucks and McDonald's voluntarily phased out plastic straws to avoid regulatory requirements and maintain brand reputation

The Role of Information and Timing

Modern stakeholder campaigns benefit from several accelerating factors:

Social media amplification enables rapid spread of information and coordinated action

Data availability through mandatory disclosures and investigative journalism

Investor engagement as ESG-focused investment strategies gain mainstream adoption

Regulatory attention as governments seek to address public concerns

Main

🔍 Stage 4: Corporate Response - The Make-or-Break Moment

When confronted with sustained stakeholder pressure, companies face a critical strategic choice: dismiss concerns and maintain current practices, or address underlying issues through operational and policy changes. This decision often determines whether an issue remains material for specific companies or evolves to affect entire industries.

The Growing Costs of Dismissal

Companies that choose to dismiss stakeholder concerns face increasingly unpredictable and potentially catastrophic consequences. The interconnected nature of modern business ecosystems means that stakeholder campaigns can rapidly impact multiple aspects of corporate operations:

The Facebook Case Study: Facebook's approach to handling concerns about hate speech and disinformation illustrates the risks of dismissal strategies. For years, the company resisted calls for more aggressive content moderation, arguing for free speech principles and technical limitations. When a coordinated advertiser boycott finally gained momentum, major brands including Unilever, Coca-Cola, and hundreds of others pulled their advertising. The result: Facebook's share price fell 8.3% in a single day, representing a $56 billion loss in market value.

Reputational Cascade Effects: In today's interconnected business environment, reputational damage can rapidly spread beyond the immediate issue:

Customer boycotts can directly impact revenue

Talent acquisition and retention becomes more difficult

Partnership opportunities may be limited as other companies seek to avoid association

Regulatory scrutiny intensifies as companies become symbols of broader systemic issues

Investor pressure mounts as ESG-focused strategies become mainstream

Strategic Response Patterns

Companies that successfully navigate stakeholder pressure typically implement measured responses characterized by three key elements:

Proportional Investment: Effective responses involve meaningful resource allocation that demonstrates genuine commitment while avoiding unnecessary costs. The key is identifying changes that provide maximum stakeholder satisfaction relative to implementation costs.

Stakeholder Engagement: Successful companies actively engage with critics rather than simply implementing unilateral changes. This engagement helps ensure that responses address actual concerns rather than perceived issues, and it can transform adversaries into advocates.

Proactive Communication: Companies that successfully manage stakeholder pressure typically get ahead of the narrative by proactively communicating their response plans and progress, rather than simply reacting to criticism.

Industry Self-Regulation vs. Individual Action

When stakeholder pressure targets industry-wide practices, companies face additional strategic considerations around collective action:

Self-Regulation Benefits: Industry-wide responses can be more effective because they:

Distribute costs across all players, reducing competitive disadvantages

Create uniform standards that benefit consumers and stakeholders

Reduce regulatory risk by demonstrating industry responsiveness

Enable knowledge sharing and best practice development

Self-Regulation Challenges: However, collective responses also face significant obstacles:

Free rider problems where some companies benefit from others' efforts without contributing

Lowest common denominator solutions that satisfy no stakeholders completely

Coordination difficulties across companies with different business models and risk profiles

Enforcement challenges without regulatory backing

Main

🔍 Stage 5: Regulation and Innovation - The New Equilibrium

The materiality process typically concludes when either regulatory intervention or technological innovation creates a new industry equilibrium with reduced misalignment between business practices and societal expectations. This final stage often involves the most dramatic changes in competitive dynamics and financial performance.

Regulatory Resolution

When corporate responses prove insufficient to address stakeholder concerns, regulatory intervention often follows. Effective regulation can rapidly transform industry practices and create new competitive dynamics:

Mining Safety Transformation: After the 2010 Upper Big Branch Mine disaster that killed 29 miners, comprehensive regulatory reforms transformed the industry. The Securities and Exchange Commission introduced mandatory mine safety disclosures as part of the Dodd-Frank Act, while the Mine Safety and Health Administration implemented enhanced oversight and enforcement. The results were dramatic: mining fatality rates fell from 0.16 per 1,000 workers (2006-2010) to 0.09 (2011-2018), while respirable dust exposure reached record lows.

Financial Services Reforms: The 2008 financial crisis led to comprehensive regulatory reforms including Dodd-Frank in the US and Basel III internationally. These changes fundamentally altered banking business models, risk management practices, and competitive dynamics across the global financial services industry.

Innovation Disruption

Alternatively, technological innovation can address underlying misalignment issues while creating new competitive advantages for early adopters:

Tesla's Electric Vehicle Revolution: Tesla's success in developing commercially viable electric vehicles that could compete with traditional internal combustion engines on performance and (increasingly) price fundamentally disrupted the automotive industry. What began as a niche luxury market has evolved into a material competitive factor:

Traditional automakers now invest billions in electric vehicle development

Governments worldwide implement increasingly aggressive electrification mandates

Supply chains are restructuring around battery technology and rare earth materials

Consumer preferences are shifting toward sustainable transportation options

Renewable Energy Transformation: Similarly, dramatic cost reductions in solar and wind energy, combined with improving battery storage technology, are making fossil fuel alternatives economically competitive without subsidies in many markets. This innovation-driven transformation is reshaping energy markets globally.

The Speed of Change

An important characteristic of Stage 5 transformations is their speed. While the earlier stages of materiality evolution can unfold over years or decades, regulatory and innovation-driven changes often create rapid, discontinuous shifts in competitive dynamics:

Regulatory changes can be implemented within months of passage

Innovation adoption follows exponential rather than linear curves once key thresholds are reached

Market dynamics can shift rapidly as early adopters gain competitive advantages

Stranded assets can emerge quickly as new standards or technologies make existing investments obsolete

WRAPPING UP

🔮 CLOSING THOUGHT: From Compliance to Competitive Advantage

The companies thriving in tomorrow's economy won't be those that simply manage today's material issues—they'll be the organizations that anticipate and prepare for the ESG challenges that haven't yet reached financial materiality.

This transformation requires a fundamental shift in how organizations approach ESG issues. Rather than viewing sustainability and social responsibility as compliance burdens or reputational necessities, leading companies are recognizing these areas as sources of competitive advantage, innovation opportunities, and long-term value creation.

The materiality evolution framework provides a roadmap for this transformation. By understanding how issues progress from background concerns to business-critical factors, leaders can:

Allocate resources more effectively across the portfolio of potential issues

Time interventions for maximum impact and minimum cost

Identify opportunities before they become widely recognized

Avoid risks that could threaten business continuity or competitive position

The question facing every organization isn't whether your industry will face new material ESG issues—it's whether you'll be ready when they arrive. Those who master the dynamics of materiality evolution will not only survive the transition but emerge stronger, more resilient, and better positioned for long-term success.

P.S. When you’re ready, here’s how I can help you:

Download our Dashboard GHG Accounting Scope 1, 2 & 3. Customize it with your organization's numbers to build a compelling business case.

Refer 2 other sustainability leader (see “Click to Share” button below)

Book a Consultation: Click HERE

GHG Accounting Strategies (Scope 1, 2 & 3)

ISO 14001 Compliance (Environmental Management)

Did you like today's email?Let me know what you thought so I can make the next email even better. |

CREDITS