- The Green Executive Briefing

- Posts

- JPMorgan Chase Sets New Standards for Carbon Market Quality

JPMorgan Chase Sets New Standards for Carbon Market Quality

➡️Sets New Standards for Carbon Market Quality

This week’s reading time: 5 minutes

Welcome to another edition of The Green Executive Briefing. In under 10 minutes, you’ll be fully updated on the latest happenings in Sustainability and ESG every Tuesday at 8am EST. 🌎

We sift through a vast array of articles and data from trusted sources, distill the information, and present it to you in simple, bite-sized pieces every week. 🌍

Subscribe Today 🌍

Topics For Today:

Rigorous Quality Standards: JPMorgan establishes 8 core principles for carbon credits, emphasizing durability, additionality, and independent verification to address widespread market integrity concerns

Multi-Billion Dollar Market Influence: As one of the world's largest financial institutions, JPMorgan's framework spans trading, financing, and purchasing activities that could reshape industry standards across voluntary carbon markets

Focus on Durable Removals: The bank prioritizes long-term carbon storage solutions over short-term avoidance credits, signaling a strategic shift toward technologies needed for net-zero emissions by 2050

More Readings

🌟 Spotlight: Terralyn.ai, Sustainability Pros Create Impact, Not Reports

Sustainability professionals create impact, not reports.

If this is the case, then why are teams spending >50% of their time handling data and reporting demands to comply with every XYZ acronym framework?

Sustainability platforms can help streamline 80% of the work, but the 20% gap is widening.

Your day is probably shuffling between systems: Email ↔️ Data warehouses ↔️ Carbon accounting platform ↔️ Excel ↔️ Reporting platform

Excel… so much work to be done in Excel

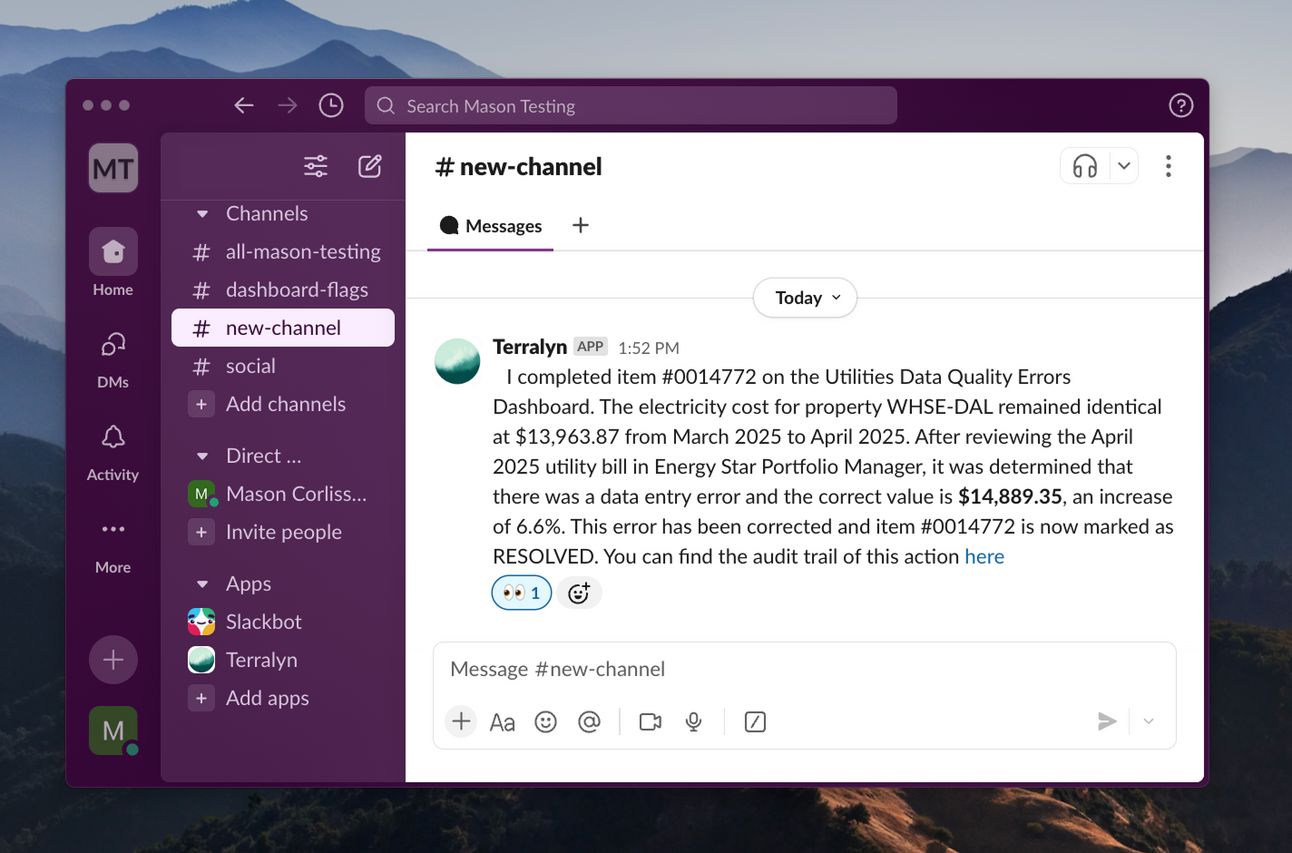

This is where we come in: Terralyn is building the first AI sustainability analyst for corporate sustainability teams, automating end-to-end workflows for data collection, data quality, analytics, and reporting—completing tasks, like a teammate, in the background 24/7.

If you can write a workflow as a list of steps, Terralyn can automate it

Terralyn is opening a private beta program for sustainability professionals where our team of experts will integrate Terralyn’s agentic capabilities into your daily workflows. If you are interested in participating, we would love to hear from you!

Feel free to find some time on my calendar link: https://calendly.com/terralyn/meeting-with-mason-at-terralyn

Mason Corliss

Founder, Terralyn

Want to get featured in the spotlight? Reply to this email: [email protected]

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

🌟 Spotlight: The Sustainable Storytelling Sprint by Solarpunk Studio

Your sustainability work deserves so much more than a checkbox—it deserves a narrative that builds trust, secures buy-in, and sparks real momentum.

The Sustainable Storytelling Sprint™ from Solarpunk Studio is a two-day immersive workshop and content creation experience designed for sustainability, ESG, and communications teams. Solarpunk Studio helps mid-sized to enterprise-level organizations translate their internal initiatives into audience-ready narratives—aligned with ESG frameworks and stakeholder priorities.

✔️Align your messaging with carbon, waste, and equity goals

✔️Train your team in visual and strategic storytelling

✔️Walk away with six months of premium, ready-to-use video and content assets

Whether you’re preparing for a report, campaign, or executive briefing, we’ll help you showcase progress with clarity and credibility.

Book a discovery call and mention the special discount for Green Executive Briefing subscribers: https://app.hellobonsai.com/s/solarpunk-studio/discovery

Want to get featured in the spotlight? Reply to this email: [email protected]

Intro

JPMorgan Chase has released a detailed framework outlining its approach to the voluntary carbon market, establishing rigorous principles that could influence how the financial sector engages with carbon credits. The bank's "Carbon Market Principles" document represents one of the most comprehensive corporate positions on carbon market quality to date.

Main

📌The Big Picture: Why This Matters

The voluntary carbon market faces significant credibility challenges. With insufficient high-quality credits and widespread concerns about the integrity of existing offerings, JPMorgan's framework addresses critical gaps that have limited the market's potential to drive meaningful climate action.

As one of the world's largest financial institutions, JPMorgan's standards could set new benchmarks for:

Credit evaluation processes across the financial sector

Project financing decisions for carbon initiatives

Market transparency and accountability measures

Main

📌JPMorgan's Eight Core Principles for Carbon Credits

The bank has established strict criteria for evaluating carbon credits, focusing on fundamental quality indicators:

Essential Requirements:

Real: All emission reductions and removals must be proven to have genuinely occurred

Measurable: Quantifiable using recognized tools against credible baselines

Additional: Projects wouldn't happen without carbon credit revenue

Unique & Traceable: One credit per metric ton of CO2 equivalent, with clear registry tracking

Independently Verified: Certified by recognized programs or third-party verifiers

Leakage Avoidance: No displacement of emissions to other locations

Durability/Permanence: Long-term carbon sequestration from the atmosphere

Climate Equity: Support for frontline, indigenous, or marginalized communities

Additional Considerations:

Strong environmental and social co-benefits

Cost-effectiveness and affordability pathways

Significant scalability potential

Innovative approaches to improve market outcomes

Main

📌Market Challenges JPMorgan Identifies

The bank outlines four critical barriers limiting voluntary carbon market effectiveness:

1. Quality Supply Shortage

Insufficient high-quality credits available

Scarcity of durable carbon dioxide removals (CDRs)

Excess of lower-quality, less expensive options

2. Market Integrity Issues

Inconsistent information quality for credit assessment

Low confidence among market participants

Financial and reputational risks from poor-quality purchases

3. Complexity and Fragmentation

Multiple competing frameworks and marketplaces

Difficult navigation for organizations

High transaction costs

4. Market Immaturity

Limited sophisticated trading capabilities

Reduced liquidity and risk management options

Barriers to diverse participant engagement

Main

📌 JPMorgan's Multi-Faceted Market Role

The bank engages with carbon markets through several business lines:

Strategic Client Support

Advising on low-carbon transition strategies

Carbon Compass℠ methodology requiring high-integrity removal credits for financing targets

Trading and Liquidity

Market-making for voluntary carbon credits

Risk management solutions including price hedging

Connecting buyers and sellers across projects

Capital Deployment

Financing carbon project development

Supporting decarbonization technology advancement

J.P. Morgan Asset Management's forest management acquisitions

Direct Purchasing

Buying credits for operational carbon neutrality since 2008

Shifting focus toward high-durability removal credits

Contributing to demand signals and best practices

Main

💡 Project Type Analysis: Benefits and Risks

JPMorgan provides detailed assessments of different carbon project categories:

Avoidance/Reduction Projects:

Forestry: High co-benefits but complex baseline establishment

Energy: Proven solutions with additionality concerns in developed markets

Agriculture: Significant potential but measurement challenges

Removal Projects:

Nature-Based (forests, soils, oceans): Shorter storage periods, lower costs

Hybrid (biochar, enhanced rock weathering): Medium-term storage, emerging scale

Engineered/Technical (direct air capture): Longest storage, highest costs, limited scale

Looking Forward: Market Evolution

JPMorgan anticipates several key developments:

Near-Term Focus:

Better evaluation of nature-based removal project durability

Support for higher-durability removal market development

Enhanced due diligence processes and transparency

Long-Term Goals:

Unified global standards advancement

Improved market infrastructure development

Broader stakeholder collaboration on market strengthening

WRAPPING UP

🔮 CLOSING THOUGHT

JPMorgan Chase's carbon market principles represent a significant step toward voluntary market maturation. As demand for climate solutions accelerates, such frameworks could help channel capital toward truly impactful decarbonization projects while building the market integrity necessary for long-term success.

Key Takeaway: Financial sector leadership on carbon market standards could accelerate both market development and climate impact, but success depends on broader industry adoption and continued collaboration among all market participants.

P.S. When you’re ready, here’s how I can help you:

Download our Dashboard GHG Accounting Scope 1, 2 & 3. Customize it with your organization's numbers to build a compelling business case.

Refer 2 other sustainability leader (see “Click to Share” button below)

Book a Consultation: Click HERE

GHG Accounting Strategies (Scope 1, 2 & 3)

ISO 14001 Compliance (Environmental Management)

Did you like today's email?Let me know what you thought so I can make the next email even better. |

CREDITS